Only one in three adults in Asia-Pacific is financially literate.1

In an era marked by complex economic systems and ever-evolving financial landscapes, the importance of financial literacy cannot be overstated. With the ability to make informed decisions about budgeting, investing, and managing debt, individuals gain a sense of empowerment that transcends each commercial transaction.

Employees at our International Headquarters in Singapore recently took the opportunity to nurture early exposure to financial literacy and build on our Employee Financial Wellness initiative at our highlight employee engagement event, Kids@Work.

PayPal’s Kids@Work experience was designed to reinforce financial management concepts through earning and spending activities powered by Near Field Communication (NFC) technology

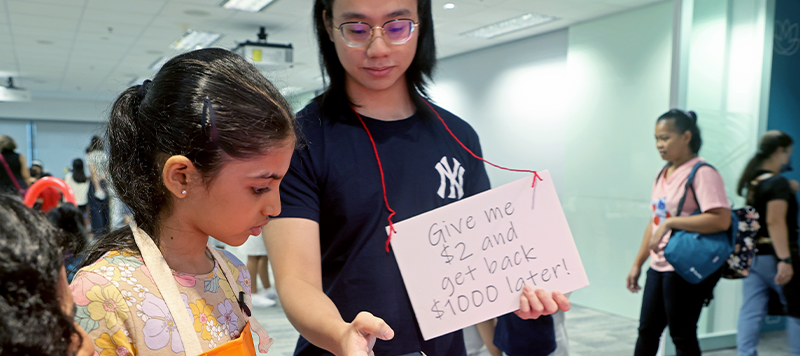

The 2023 PayPal Kids@Work experience was designed to reinforce financial management concepts through earning and spending activities powered by Near Field Communication (NFC) technology. Children of PayPal employees received a NFC wristband pre-loaded with credit that they used throughout the day, along with a budget planner that their parents leveraged to help them manage expenses. There were also opportunities to earn extra credits, and engage with a “roaming scammer” to give kids their first exposure to online fraud.

Children of PayPal employees are given their first exposure to online fraud with a roving scammer

Lifelong Impact: Early Financial Literacy and Its Significance

The benefits of exposure to financial concepts at an early age is clear: reduced anxiety and instilled confidence. Equipped with the right knowledge, skills and confidence, youths can make well-informed decisions about life that have a long-lasting positive impact well into adulthood. But early financial wellness does more than just secure personal futures; it nurtures the foundation of financially responsible communities. The positive impact resonates far beyond the individual, contributing to a society marked by economic empowerment and well-informed citizens.

The heart of PayPal's commitment to its employees’ total wellness lies in a holistic approach that encompasses not only physical and mental health, but also financial health

Prioritising Employee Total Wellness

In 2015, PayPal and then newly appointed CEO, Dan Schulman, embarked on a mission to democratize financial services. With our employees being one of our most important stakeholders, the journey eventually led us to look inward at the financial health of our employees. In 2019, we established an enterprise-wide goal to reach at least 20% PayPal-defined estimated net-disposable income (eNDI) for our employee globally in an effort to help promote the financial wellness of our employees. We exceeded our goal in 2022, with all employees achieving an eNDI of at least 26% across our global locations.

The heart of PayPal's commitment to its employees’ total wellness lies in a holistic approach that encompasses not only physical and mental health, but also financial health. PayPal’s Employee Financial Wellness initiative comprises four pillars: wage increases, reduction in health care premiums, equity grants and financial coaching resources. It continues to be a cornerstone of our overall wellness strategy.

Related Articles