Indian small businesses prioritise cross-border trade & social selling to survive and thrive says PayPal’s MSME Digital Readiness Survey

Businesses to leverage technology for a seamless check-out experience to garner a greater share of consumer wallets

PayPal, a global leader in digital payments has launched the findings of its “MSME Digital Readiness Survey” in partnership with Edelman Data and Intelligence. The survey aims to understand how Indian MSMEs have adapted during the pandemic by adopting a digital first approach, while leveraging the global opportunity and their key priorities to scale up.

Conducted between October to November 2021, PayPal’s MSME Digital Readiness Survey assesses the impact of COVID-19 on small businesses that have an online presence. The results are based on interviews with 250 business decision markers of India’s small and medium enterprises, which are defined as having an annual turnover of INR 5 to less than 250 crore. The businesses show an average turnover of INR 123 crore and an average employee size of 386 persons. The sample endorses a mix of industry, mainly comprising the Services (36%), Production (28%) and Retail & Hospitality (16%) sector.

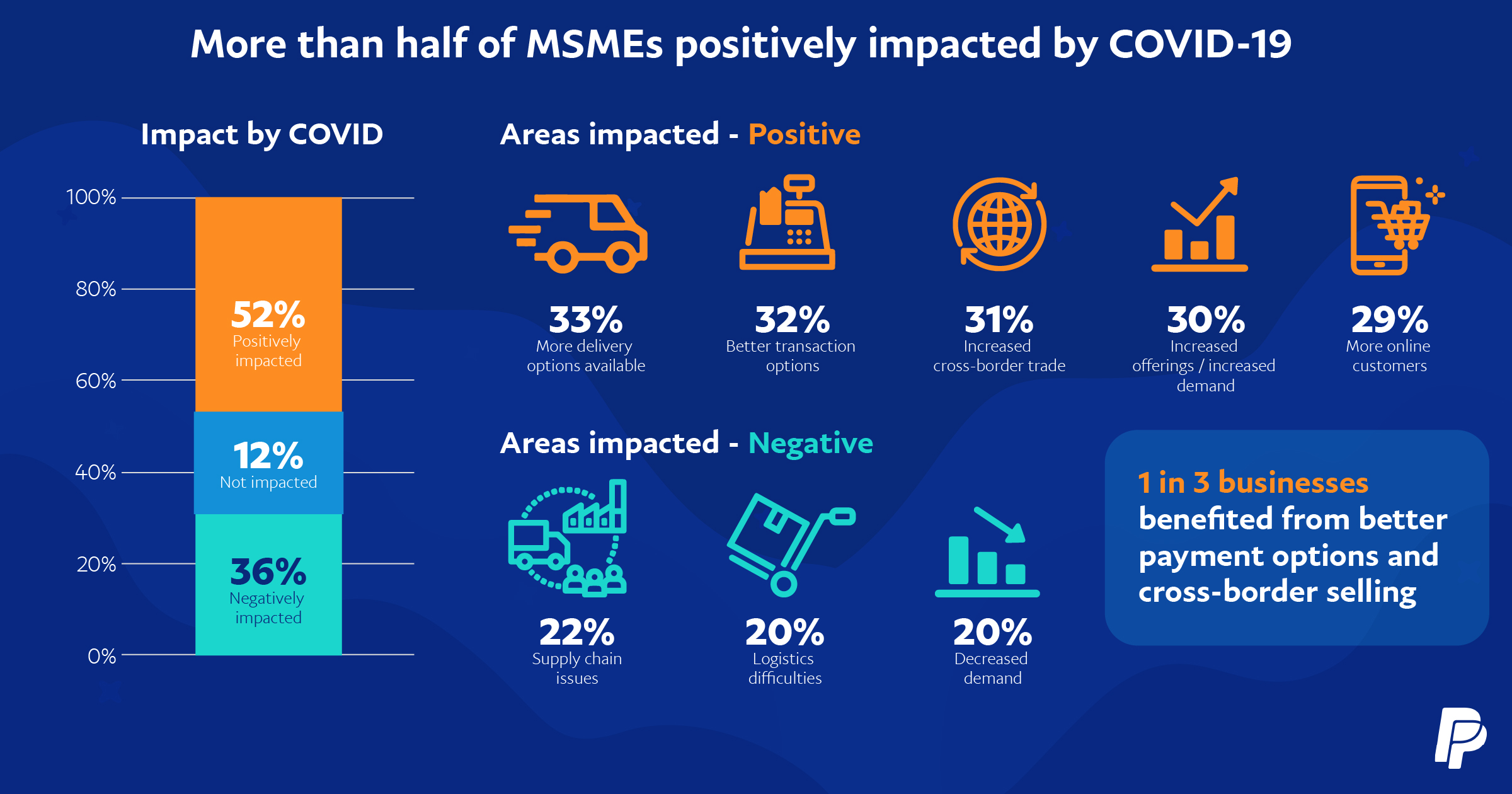

- 52% of Indian MSMEs saw a positive business impact post pandemic

- Over a quarter of those who are already selling on social media began to do so during the pandemic and over half of all surveyed SMBs saw it as a key driver for growth in the last 12-months.

- 65% of India’s MSMEs claimed to have embraced social media after seeing their competitors do the same.

- 49% of respondents expressing a keen interest in developing their own website or app

- 94% recognized that transcending borders results in growth and are making cross-border trade a priority moving forward

- 98% expressing an interest in investing in more digital payment options

- 38% of MSMEs surveyed are planning to invest in an optimal checkout and payment experience

Consumer adoption of digital continues to benefit MSMEs

There’s been a shift in consumer behaviour induced by the lockdowns. It has paved way for purchasing from virtual stores. MSMEs have positively seen a 65% increase in online buying from customers and close to 80% shared that their consumers are more receptive to using different payments options. The ease, accessibility and adoption of digital methods has led 51% of MSMEs to see an increase in spending from existing customers while 46% witnessed an increase in repeat purchases.

Building an owned online presence is a key priority going forward

MSMEs have shown great resilience and tenacity to overcome the downfalls of COVID-19 by leveraging the digital opportunity and increasing their online presence. Currently, 66% of MSMEs use social media as an online selling channel, followed by marketplace (62%), company owned platforms i.e. app (61%), own ecommerce website (54%) and third party ecommerce platforms (54%).

Unlike third-party platforms, owned company channels typically provide business owners with more flexibility, control and freedom when selling online. With the change in consumer behaviour, businesses are also shifting their priority - intentions to adopt a company ecommerce website and company owned platforms to engage in online selling are highest at 29% and 28%, respectively.

This is important for India’s MSMEs as 49% of respondents express a keen interest in developing their own website or app. However, this independence does bring with it some concerns, most notably the availability of technical expertise. Over half of the respondents (56%) who do not currently sell on their own channels cited a lack of technical knowledge as being the number one barrier

Social media to be a key growth enabler for businesses; competition propelling adoption

Digital has been a key growth driver for Indian small businesses. Like Singapore and Hong Kong, social media is the most popular online selling channel. It has been noted that 26% of those who are already selling on social media began to do so during the pandemic and 56% of surveyed MSMEs saw it as a key driver for growth in the last 12-months.

While user-friendly interface (67%) and natural transition from non-sale purpose to selling (67%) are top reasons to utilise social media platforms for selling, a notable reason for embracing it is competition. Business is more competitive now than it ever has been. 65% of Indian MSMEs claimed to have embraced social media after seeing their competitors do the same.

Apart from the fact that selling on social media is extremely easy and promotes healthy competition, it has also helped brands understand and educate their audience on social causes.

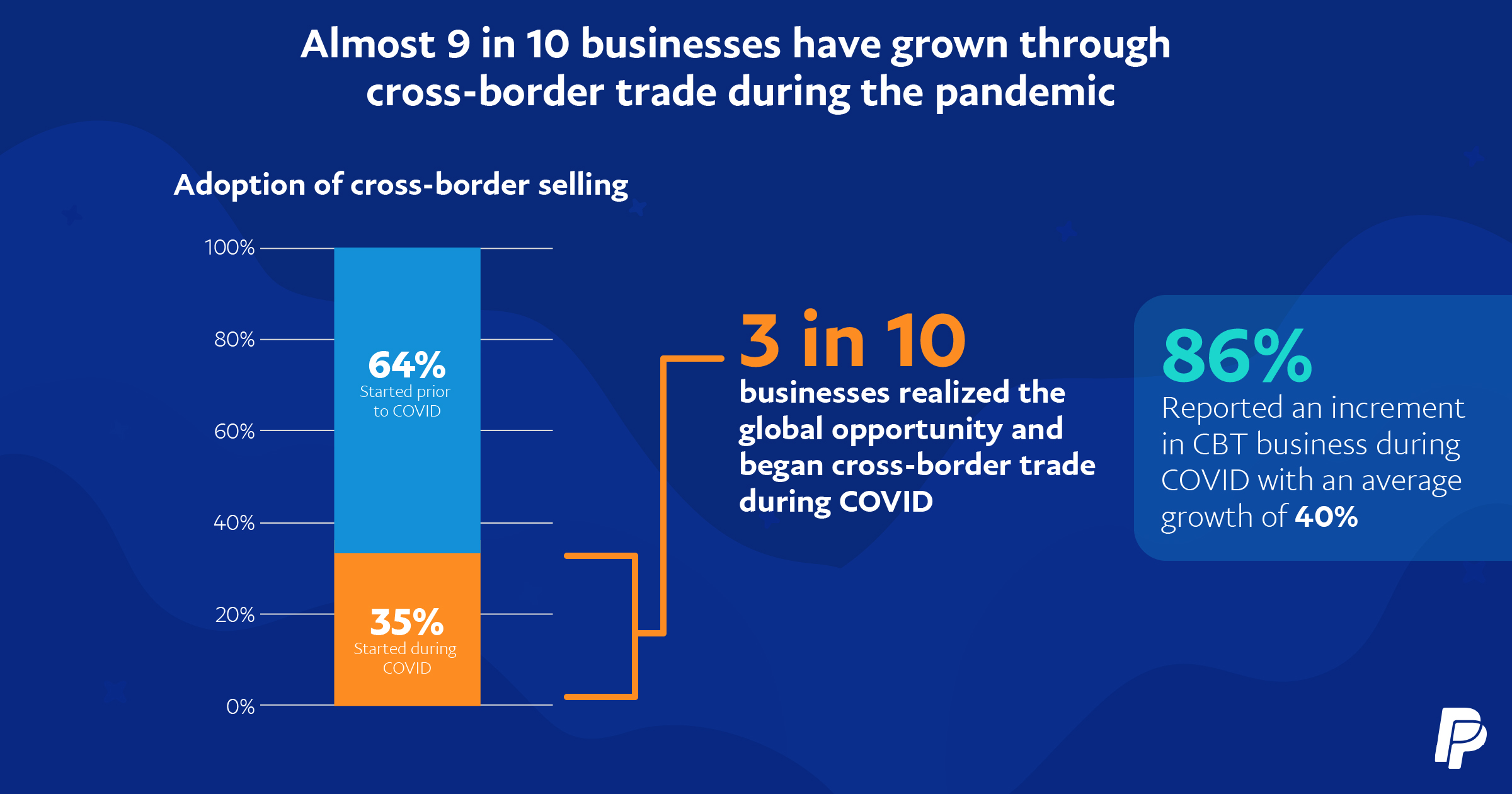

Close to 100% Indian MSMEs agree that cross border trade must be a business priority over the next year

Adoption of cross-border in India is high - 64% of the merchants had adopted cross-border before the pandemic while 35% did during the pandemic. Out of all, 86% MSMEs selling globally claimed that they recorded growth in cross border trade during COVID-19. Much of this success can be attributed to the reopening of other economies and positive sentiment from global consumers. 94% recognized that transcending borders results in growth and are making cross-border trade a business priority moving forward.

Through developments in technology, taking a business beyond borders is doable

MSMEs have called out certain challenges associated with doing business across borders like high costs (74%), exchange related issues (31%), and fraud-related concerns (30%). To overcome such issues, MSMEs have been partnering with third-party online selling platforms, developing their own websites and apps, digitizing internally preparing for online selling, and adopting of a global payment system.

Digital payments and technology backed seamless check-out experience are a focus area says Indian MSMEs

As more and more Indian MSMEs embrace digital, investment into their digital journey has become a key priority. 98% of the surveyed businesses have expressed an interest to invest in more payment options. Of this, 95% are looking to introduce newer ways of payment and 89% are keen on optimizing card payments. This is followed by optimization of services to accept digital wallets like PayPal (70%).

An emerging area of interest for small businesses is the check-out experience they provide to customers. Close to 40% are planning to invest towards improving the checkout and payment process in order to increase sales. The key reasons to do so as stated by the small businesses is to accept payment from new digital sales channels (60%), integrate loyalty schemes (57%), expand new, local payment methods to sell cross border (56%), amongst others.

With increased competition, businesses are fighting for a consumers share of wallets. 49% of Indian MSMEs surveyed will invest in technology to offer a better customer experience. A seamless check-out experience will mean increased customer loyalty as well as the ability to expand their consumer base.